rsu tax rate india

Also Uber should move to a better brokerage. Tax treatment of RSUs in India.

Restricted Stock Unit Rsu What It Is How It Works Seeking Alpha

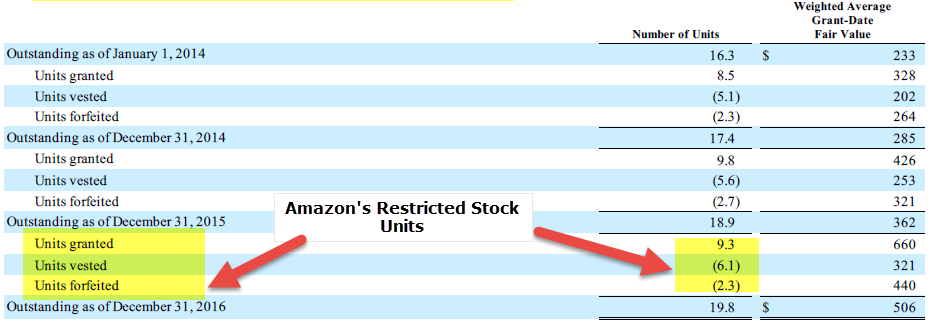

Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

. Upon vesting your stocks fair market value is taxed at the same rate as your ordinary income. For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income.

Taxation on ESPP ESOP and RSU. You should consider it in the following way. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

This 2000 was value created by holding onto the stock and it performing well and was not value. Sale value added to income tax amount. What is the tax rate for an RSU.

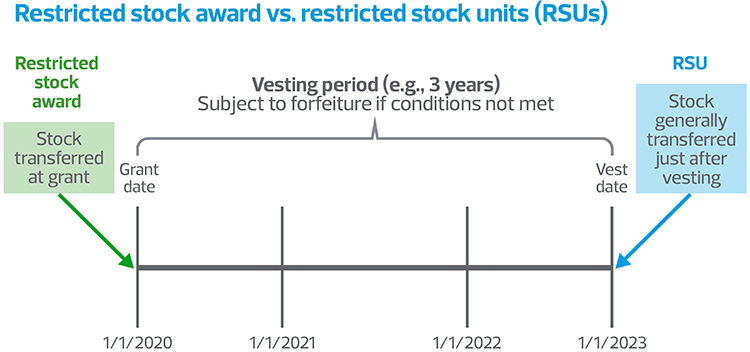

Its important to remember that the RSU tax rate will be the same as your income tax rates. Selling RSUs within 2 years of acquisition. The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in.

The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in. India taxes investment gains based on a lock-in or holding period. This rate is 238 20.

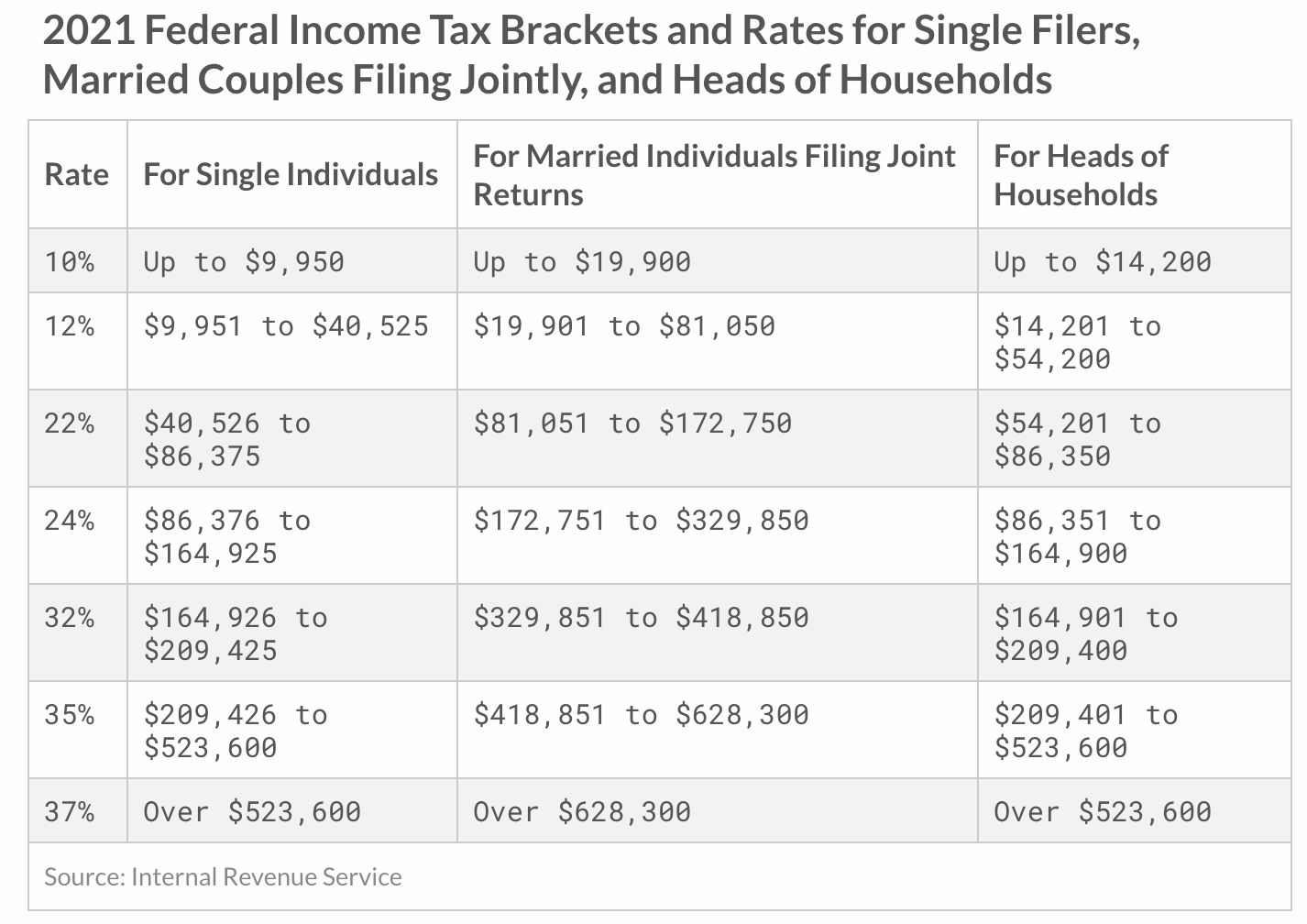

The 312 tax is for the income you were provided in the form of RSUs. The timing of rsu tax is exactly the same as any other. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

Also restricted stock units are subject. And the way I look at things this is just. The exact tax rate will.

Pay income tax after adding such shares to taxable income. Alice is now liable for paying capital gains tax on the 2000 appreciation. If population exceeds 10 lakhs but up to 25 lakhs.

Hello Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes. This is true whether were talking. Investments in equity or equity-linked mutual funds for more than one year are considered as long-term and.

Is the top marginal tax rate in India 43 including surcharge etc If not I cant see any case where it would be required. RSU Withholding Rate A Common Confusion. What is the tax rate for an RSU.

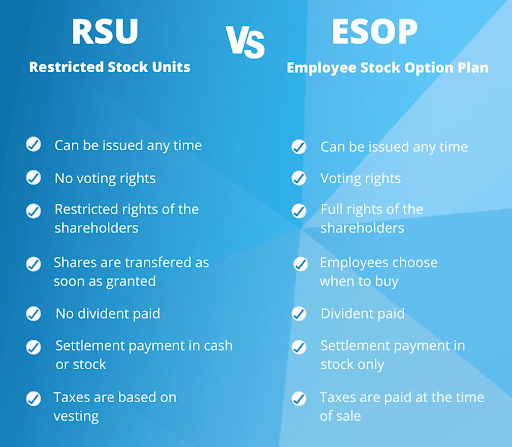

RSU Tax Rate vs. The governments proposal to reduce the GST rate on electric vehicles from 12 to 5 per cent was recently accepted by the GST Council. The rules that govern the taxation of ESPP ESOP and RSUs are the same as they all deal with stocks that an employee receives and the taxation rules are.

For senior citizens the exempt income is rs 3 lakhs and for super. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Your tax rate will depend on your specific tax.

Assume you were given 100k in the form of income that 100k is taxed as.

Income Tax Implications On Rsus Or Espps

Frequently Asked Questions About Restricted Stock Units

What Are The Differences Between Esop Rsu And Phantom Stocks

Understanding Esops Rsus Espps India S First Online Finance Dictionary

Restricted Stock Units Definition Examples How It Works

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

The Taxation Of Rsus In An International Context Sf Tax Counsel

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Of Mnc Perquisite Tax Capital Gains Itr

A Guide To Restricted Stock Units Rsus And Divorce

Restricted Stock Units Definition Examples How It Works

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium